These tech support refund scams are similar to the usual tech support scam, but they differ in a few ways. Let’s look at how scammers set up refund scams so you can identify the signs and stay safe.

What Is a Refund Scam?

If you ever sold something online, you may be familiar with refund scams already. After you sell an item, the buyer will “accidentally” overpay you for an item you are selling. In some cases, they will say the extra amount should be paid to a shipping company or agent of their choice. What happens after is they cancel the initial overpayment altogether and steal what you sent.

The tech support refund scam is similar but incorporates elements of the classic tech support scam. You receive a phony email alerting you of a pending refund for some service, and when you reach out via phone, the scammers pretend to refund the money. Again, “by mistake” they may overpay you and ask to send the extra money back using gift cards or money transfer services. Sending them money this way means you’ll never get it back and it’s virtually untraceable!

A common variation is when scammers want to “verify” your bank account, and they can only do that if they see your bank account number with their eyes.

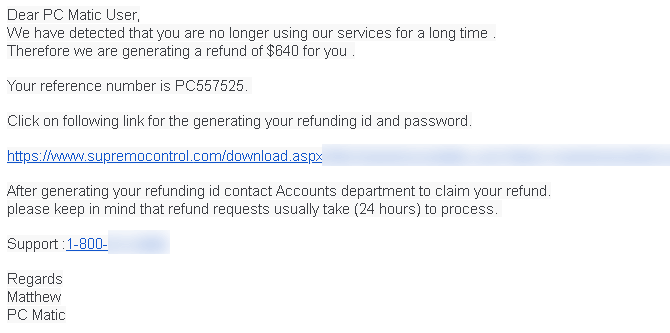

Here is an example of what their emails typically look like

If you click on the link in the email, they will ask you to install remote control software on your computer and then contact the scammers. Legitimate IT companies (including us) use the same programs to help people, and you might recognize their names – TeamViewer, LogMeIn, Anydesk, etc…

After scammers gain control of your computer, they will ask you to log in to your bank so they can “verify” your account and initiate the refund. You already know (or will notice) how much money is on your checking account and scammers will use this information to deceive you. They will black out your screen so you can’t see what exactly they are doing, claiming this is what makes the process “secure”.

Of course, they won’t transfer money to your bank. Since most people have more than one bank account (such as savings or retirement), they will transfer money between your accounts to “increase” your checking account balance. All this is done to further fool and distract you. When they transfer money from your savings, they will also send some of it to themselves if your bank allows it. If it doesn’t, they will proceed to claim they accidentally overpaid you… and you know how that ends.

If you start to suspect something and don’t cooperate with them, they still have access to your computer! They can put a password on it or encrypt your system just to piss you off.

If you ever get these calls, our advice is to hang up immediately. If scammers do manage to gain remote access to your computer, turn it off instantly and ask a reputable IT company for help!